E-Invoicing Made Practical for Growing Businesses in the UAE

For many businesses in the UAE, e-invoicing has become the standard to ensure accountability and compliance. Forward-thinking organizations have turned to advanced invoicing tools to ensure VAT accuracy and maintain digital records. This ensures their audit readiness and long-term traceability.

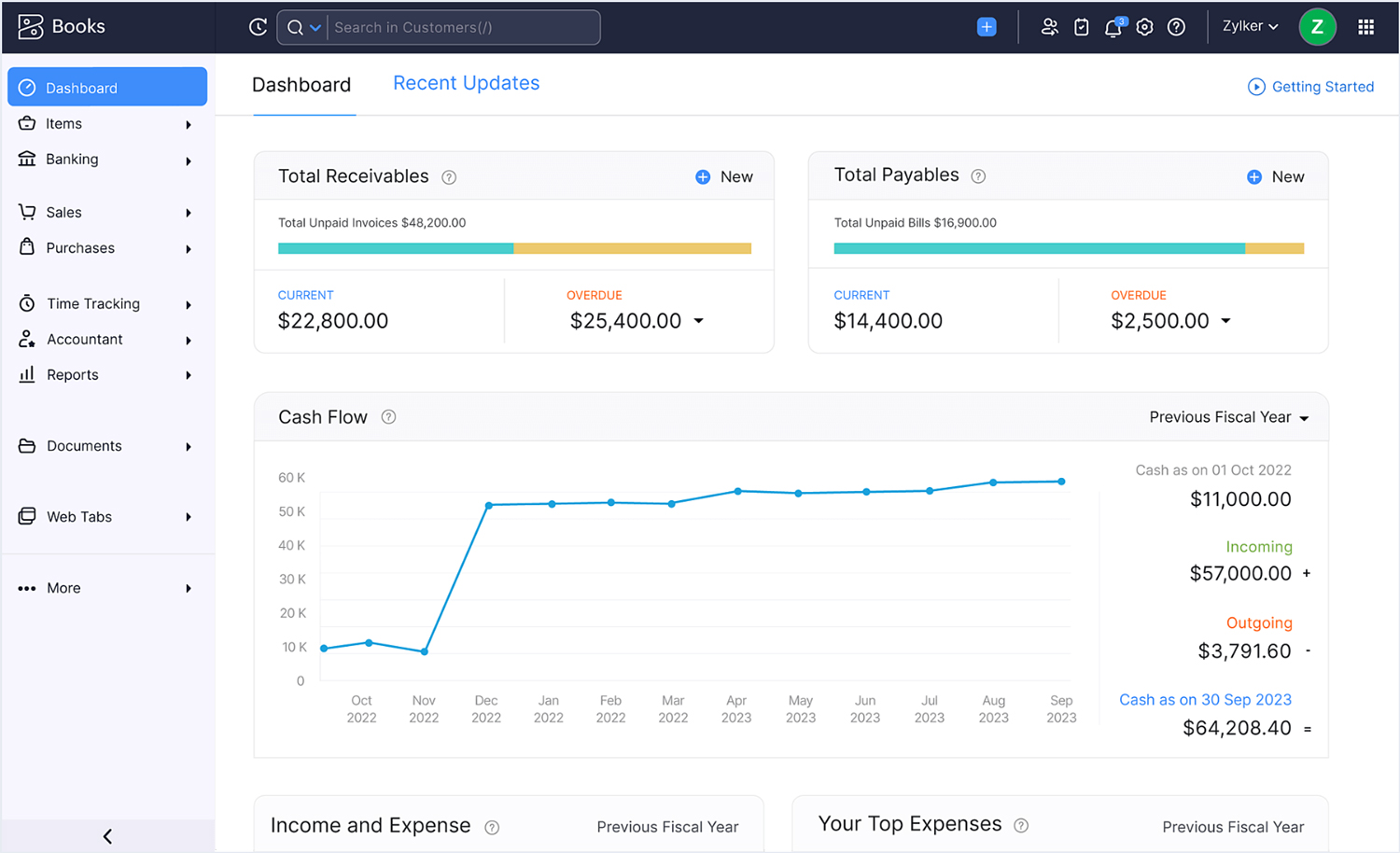

What looks like a small operational change externally actually influences finance teams, auditors, and leadership decisions. This is where tools like Zoho Books prove beneficial, not because they are feature-rich, but because they streamline invoicing and accounting processes.

E-invoicing in the UAE is not just about sending a PDF by email. It’s about structured data, correct tax treatment, and records that can help businesses during the scrutiny months or years later.

Where Most Businesses Actually Struggle

The biggest challenge isn’t understanding the regulation. It’s execution.

Many companies still rely on:

- Spreadsheets

- Legacy accounting tools

- Partially connected systems

They work, until problems start showing up. VAT calculations need manual review. Invoice formats vary by client. Historical data remains scattered across different places. When e-invoicing becomes mandatory, these gaps become visible.

A clean setup in Zoho Books changes that experience. VAT algorithms are already built in. Invoice templates follow local requirements. Records are stored in a way that maintains transparency during audits. Instead of reacting to compliance, finance teams can move back to managing numbers.

For businesses moving from older systems, a structured migration is critical. A rushed switch often leads to broken balances and missing history. This is where working with the best Zoho implementation partner in the UAE makes a real difference. The goal is not just moving data, but preserving financial continuity.

Clarity Removes Complexity from Systems

Once e-invoicing runs smoothly, something interesting happens. Finance teams stop spending time checking invoices and start using the data.

With Zoho Books, invoice status, tax exposure, receivables, and expenses are visible in real time. There’s no waiting for month-end to understand cash flow. This level of clarity helps in making better decisions, particularly for growing businesses that need to stay flexible.

Integration plays a quiet but important role here. When accounting is properly synced with sales and operations, information flows naturally.

This is where experienced Zoho consulting services in Dubai add value, aligning the system with how the business actually runs.

Software Alone Isn’t the Solution

Many companies assume buying the software is the hard part. But it isn’t.

The real work is in configuration, training, and making sure people trust the numbers they see. Approval flows, tax settings, reporting structures, and user roles all affect whether or not a team is using the system properly.

Choosing the best Zoho implementation partner in the UAE is essential to streamline e-invoicing. These professionals understand your industry and transaction volume. Thus, you get to know where errors usually happen. This expert guidance saves time down the line.

Experienced partners also help businesses think ahead. As operations grow, reporting needs change. At the same time, licenses evolve, and integrations expand. With Zoho consulting services in Dubai, organizations can rest assured that their businesses keep growing.

Comprehensive Features of Zoho Books

Apart from e-invoicing, Zoho Books streamlines processes with a wide range of features. These include:

- Vendor payments

- Expense tracking

- Inventory Banking feeds

- Reminders

All these details are available in one place. When integrated with other Zoho applications, finance becomes part of a larger digital infrastructure. This is the shift many businesses in the UAE are making.

Why Choose Xponential Digital for Professional Zoho Consulting Services in Dubai

At Xponential Digital, we are your trusted Zoho implementation partner and work with businesses that need reliable accounting systems. From migration to implementation and ongoing optimization, we prioritize clarity and compliance. If your current setup feels like it’s one regulation away from breaking, it may be time to rethink the foundation.

Xponential Digital

Xponential Digital